Introduction

Managing your personal finances effectively is crucial for securing a stable and prosperous future. With proper financial planning, you can achieve your goals, whether it’s buying a home, retiring comfortably, or simply living debt-free. In this article, we’ll explore ten essential personal finance tips that will help you take control of your financial life and set yourself up for long-term success.

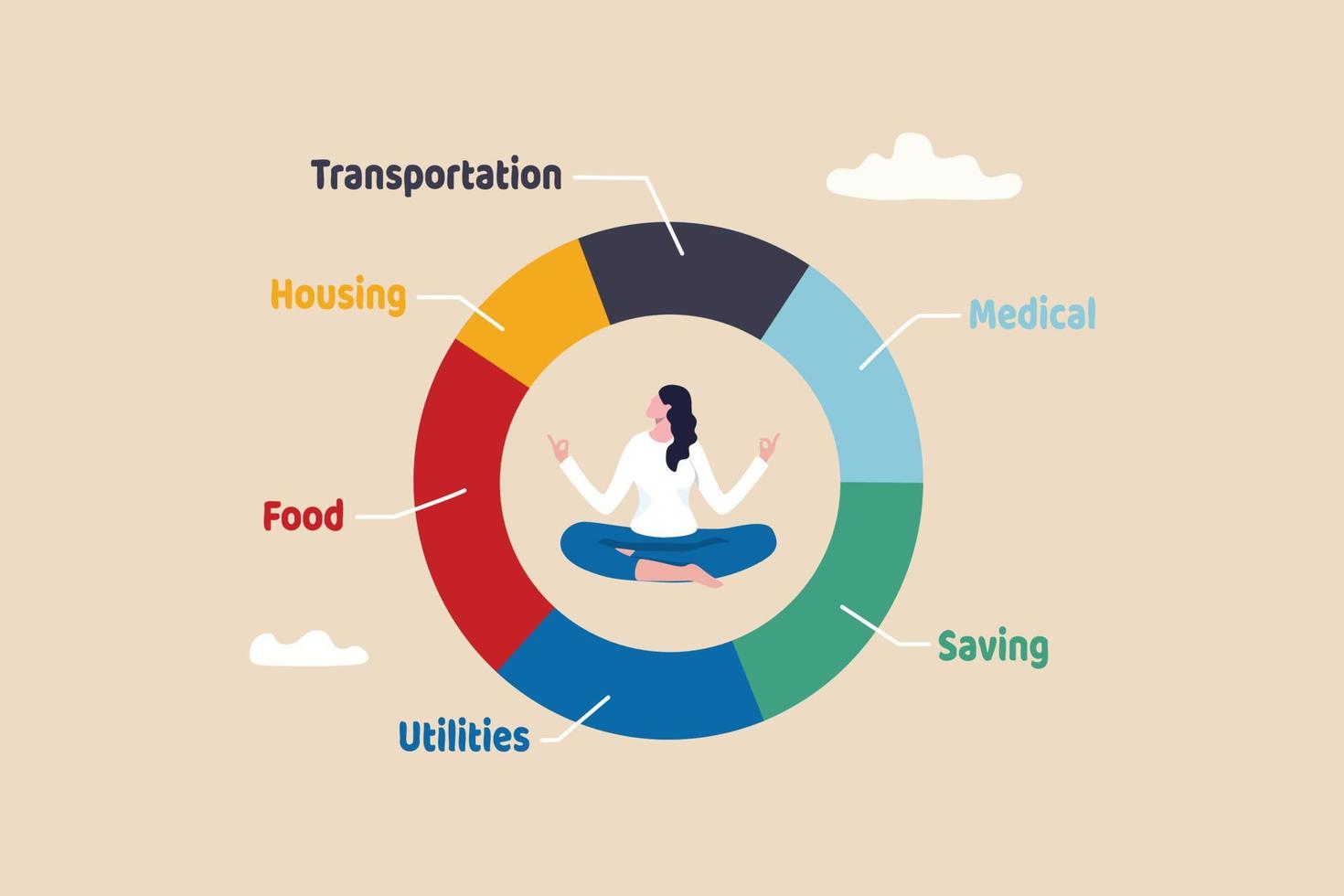

1. Create a Budget and Stick to It

A well-structured budget is the cornerstone of good financial management. Start by tracking your income and expenses to understand where your money goes each month. Categorize your spending (e.g., housing, food, entertainment) and identify areas where you can cut back. Use budgeting apps or spreadsheets to stay organized. The key is consistency—review and adjust your budget regularly to ensure it aligns with your financial goals.

2. Build an Emergency Fund

Life is unpredictable, and unexpected expenses can derail your financial plans. That’s why it’s essential to have an emergency fund. Aim to save at least three to six months’ worth of living expenses in a separate, easily accessible savings account. This fund will provide a safety net in case of job loss, medical emergencies, or major repairs, helping you avoid debt during tough times.

3. Pay Off High-Interest Debt First

Debt can be a significant burden, especially when it comes with high-interest rates. Prioritize paying off debts with the highest interest rates first, such as credit card balances or payday loans. This strategy, known as the debt avalanche method, minimizes the amount of interest you pay over time. Once high-interest debts are cleared, focus on paying off other debts to improve your financial stability.

4. Invest in a Diversified Portfolio

Investing is key to growing your wealth over time, but it’s important to do so wisely. Diversify your investment portfolio by spreading your money across different asset classes, such as stocks, bonds, and real estate. This reduces risk and increases the potential for steady returns. Consider low-cost index funds or exchange-traded funds (ETFs) as part of your strategy, and always align your investments with your risk tolerance and financial goals.

5. Automate Savings and Investments

Automating your savings and investments ensures that you consistently put money aside without needing to think about it. Set up automatic transfers from your checking account to your savings account or investment accounts each month. This “set it and forget it” approach helps you build wealth effortlessly and prevents the temptation to spend money that should be saved.

6. Regularly Review and Adjust Your Financial Goals

Your financial goals may change over time, and it’s important to review and adjust them regularly. Set specific, measurable, achievable, relevant, and time-bound (SMART) goals, and track your progress. Whether you’re saving for a down payment on a house, planning for retirement, or paying off student loans, keeping your goals updated will keep you motivated and on track.

7. Maximize Retirement Contributions

Saving for retirement should be a top priority in your financial plan. Take full advantage of employer-sponsored retirement plans, such as 401(k)s, by contributing enough to get the full employer match—it’s essentially free money. If you’re self-employed or your employer doesn’t offer a retirement plan, consider opening an Individual Retirement Account (IRA). The earlier you start saving for retirement, the more time your money has to grow.

8. Understand and Improve Your Credit Score

Your credit score is a critical factor in your financial health, affecting your ability to borrow money, secure a mortgage, or even rent an apartment. Regularly check your credit report for errors and take steps to improve your score, such as paying bills on time, reducing credit card balances, and avoiding new debt. A good credit score can save you thousands of dollars in interest over your lifetime.

9. Avoid Lifestyle Inflation

Lifestyle inflation occurs when your spending increases as your income rises. While it’s tempting to upgrade your lifestyle with each raise or bonus, this habit can prevent you from achieving long-term financial goals. Instead, maintain your current standard of living and allocate the extra income towards savings, investments, or paying off debt. This approach will help you build wealth faster and avoid unnecessary financial stress.

10. Seek Professional Financial Advice

Managing finances can be complex, especially as your wealth grows. Consider seeking advice from a certified financial planner (CFP) or other financial professionals who can help you create a comprehensive financial plan. They can offer personalized guidance on topics like investing, tax planning, and estate planning, ensuring that your financial decisions align with your long-term goals.

Conclusion

By implementing these ten essential personal finance tips, you can take control of your financial future and achieve your long-term goals. Remember, financial success doesn’t happen overnight—it’s about making smart, consistent choices over time. Start today, and you’ll be well on your way to a secure and prosperous future.